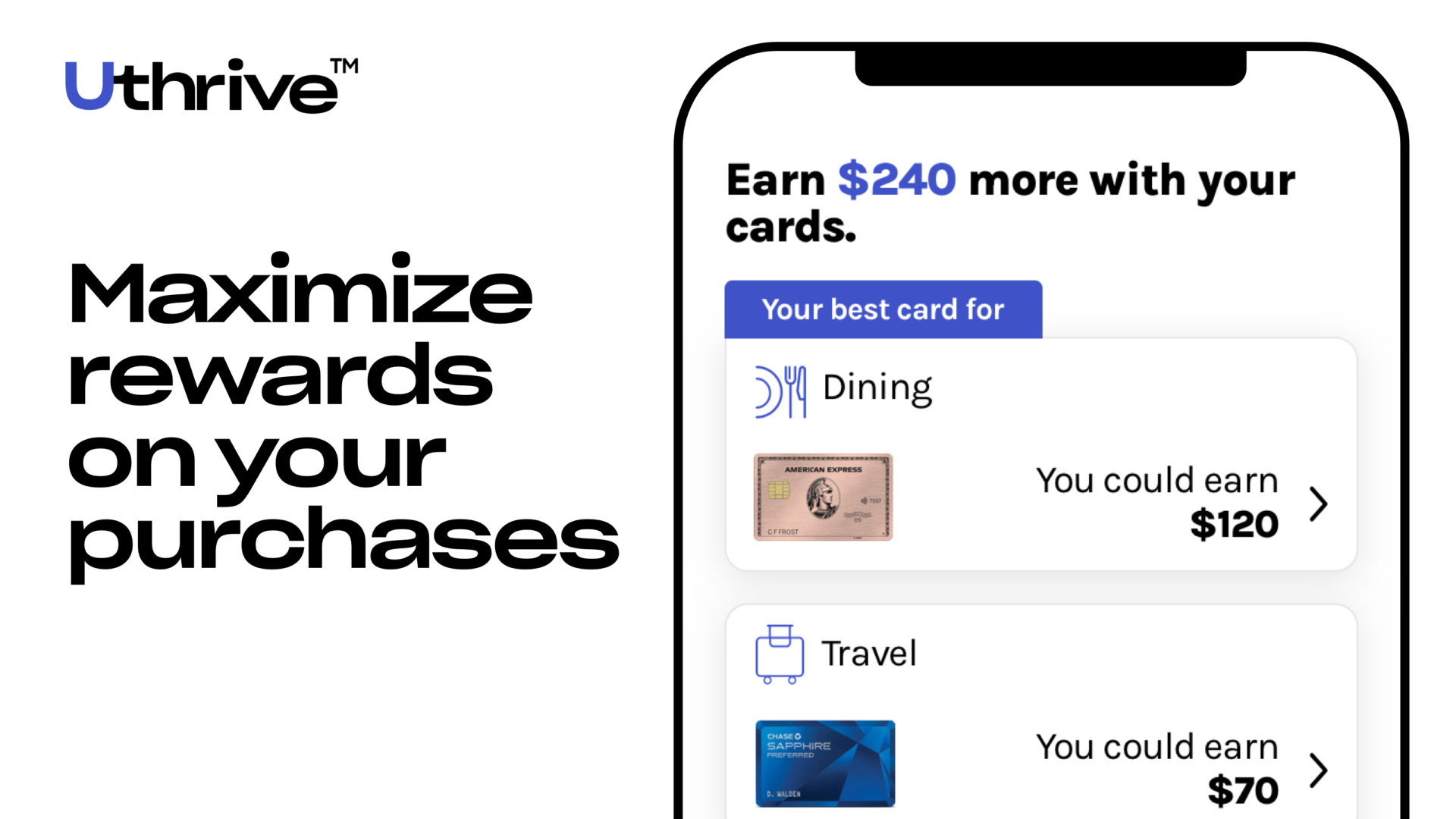

A single credit card for all your purchases? We do not think that is a good option because every card is designed differently. In the ocean of Credit Cards, it is challenging for most people to get the best-fitted card for their wallet.

Uthrive experts are committed to helping you make the right choice to get you maximum cash back, rewards, balance transfer, free travel, 0% APR, and lots more.

Ranging from a great welcome bonus with no annual fees to various special features, the key to finding the best credit card depends upon your lifestyle, needs, and spending habits. Here is a list of best cards to align with your spending habits and priorities:

Maximum Cash Back for Everyday Spend Blue Cash Preferred® Card from American Express

This card is a great choice for families. See your savings grow with card_name benefits including 6% cash back at U.S. supermarkets (up to $6,000 per year in purchases), 6% back on select U.S. streaming subscriptions, and 3% back on transit and gas, which makes it one of the highest cash back credit cards. Blue Cash Preferred® Card from American Express also offer an Introduction APR of intro_apr_rate,intro_apr_duration, then reg_apr,reg_apr_type

| |||||

No Annual Fee Credit Card for Entertainment & Foodies Capital One SavorOne Cash Rewards Credit Card

The card_name is an excellent choice for individuals who enjoy dining out and entertainment. | |||||

Best Travel Rewards Credit Card Chase Sapphire Preferred® Card

The card_name is a popular travel rewards credit card offering rich benefits, from a big sign-up bonus of bonus_miles_full To juicy dining and traveling rewards on your spending. | |||||

Best for Travel, Dining and Commuting card_name

card_name is meant for you if you want a credit card for travel that earns generous 3X Membership Rewards points across the widest array of travel categories. Amex Green Card benefits also include $189 annual CLEAR® Plus membership credit to breeze through airport security and $100 credit to purchase lounge access and an exciting offer of bonus_miles_full

| |||||

No Fee Cash Back Credit Card for Families Blue Cash Everyday® Card from American Express

card_name is a great option for individuals who spend a lot on everyday purchases such as at U.S. supermarkets, U.S. gas stations and select U.S. online retail purchases, and want to earn cashback rewards without an annual fee. This card also offers a bonus of bonus_miles_full And an intro APR of intro_apr_rate,intro_apr_duration, then reg_apr,reg_apr_type*

| |||||

Popular Travel Rewards Credit Card Capital One Venture Rewards Credit Card

The card_name is a popular travel rewards card that offers generous miles and valuable benefits for frequent travelers. With a $95 annual fee and a flat-rate rewards structure, the card allows users to earn unlimited 2X miles on every purchase, redeemable for travel expenses such as flights, hotels, and rental cars.

| |||||

Points and Perks on Dining, Groceries & more American Express® Gold Card

card_name is a great way to earn the maximum Membership Rewards® points. It provides 4X points per dollar on restaurants worldwide and 4X on US Supermarkets up to $25,000 purchases each year. Plus 3X on Flights booked directly with airlines or amextravel.com and an enticing offer of bonus_miles_full

| |||||

Up to 5% Cash Back Card with No Annual Fee Ink Business Cash® Credit Card

The Ink Business Cash® Credit Card is one of the best business cards offered by Chase. Card holders with Ink Business Cash® Credit Card earn ultimate rewards, which can be redeemed as cash back. This card offers 5% cash back on office supply stores as well as on internet, cable, and phone service providers up to $25,000 in combined purchases each year.

| |||||

Unlimited Cash Back Card with No Annual Fee Capital One Quicksilver Cash Rewards Credit Card

Capital One Quicksilver Cash Rewards Credit Card offers unlimited 1.5% cash back on all purchases - making it a simple cash back card that rewards you on every swipe, all with No annual fees.

| |||||

Strong cash back card with no fee Chase Freedom Unlimited®

The card_name credit card is a solid choice for those who seek cashback for everyday expenses. With no annual fee, an attractive sign-up bonus of bonus_miles_full And impressive cashback rates up to 5%, it also offers intro_apr_rate,intro_apr_duration, then reg_apr,reg_apr_type.

|

Maximum Cash Back for Everyday Spend |

This card is a great choice for families. See your savings grow with card_name benefits including 6% cash back at U.S. supermarkets (up to $6,000 per year in purchases), 6% back on select U.S. streaming subscriptions, and 3% back on transit and gas, which makes it one of the highest cash back credit cards. Blue Cash Preferred® Card from American Express also offer an Introduction APR of intro_apr_rate,intro_apr_duration, then reg_apr,reg_apr_type

| ||||

No Annual Fee Credit Card for Entertainment & Foodies  |

The card_name is an excellent choice for individuals who enjoy dining out and entertainment. | ||||

Best Travel Rewards Credit Card |

The card_name is a popular travel rewards credit card offering rich benefits, from a big sign-up bonus of bonus_miles_full To juicy dining and traveling rewards on your spending. | ||||

Best for Travel, Dining and Commuting  |

card_name is meant for you if you want a credit card for travel that earns generous 3X Membership Rewards points across the widest array of travel categories. Amex Green Card benefits also include $189 annual CLEAR® Plus membership credit to breeze through airport security and $100 credit to purchase lounge access and an exciting offer of bonus_miles_full

| ||||

No Fee Cash Back Credit Card for Families |

card_name is a great option for individuals who spend a lot on everyday purchases such as at U.S. supermarkets, U.S. gas stations and select U.S. online retail purchases, and want to earn cashback rewards without an annual fee. This card also offers a bonus of bonus_miles_full And an intro APR of intro_apr_rate,intro_apr_duration, then reg_apr,reg_apr_type*

| ||||

Popular Travel Rewards Credit Card |

The card_name is a popular travel rewards card that offers generous miles and valuable benefits for frequent travelers. With a $95 annual fee and a flat-rate rewards structure, the card allows users to earn unlimited 2X miles on every purchase, redeemable for travel expenses such as flights, hotels, and rental cars.

| ||||

Points and Perks on Dining, Groceries & more |

card_name is a great way to earn the maximum Membership Rewards® points. It provides 4X points per dollar on restaurants worldwide and 4X on US Supermarkets up to $25,000 purchases each year. Plus 3X on Flights booked directly with airlines or amextravel.com and an enticing offer of bonus_miles_full

| ||||

Up to 5% Cash Back Card with No Annual Fee |

The Ink Business Cash® Credit Card is one of the best business cards offered by Chase. Card holders with Ink Business Cash® Credit Card earn ultimate rewards, which can be redeemed as cash back. This card offers 5% cash back on office supply stores as well as on internet, cable, and phone service providers up to $25,000 in combined purchases each year.

| ||||

Unlimited Cash Back Card with No Annual Fee |

Capital One Quicksilver Cash Rewards Credit Card offers unlimited 1.5% cash back on all purchases - making it a simple cash back card that rewards you on every swipe, all with No annual fees.

| ||||

Strong cash back card with no fee |

The card_name credit card is a solid choice for those who seek cashback for everyday expenses. With no annual fee, an attractive sign-up bonus of bonus_miles_full And impressive cashback rates up to 5%, it also offers intro_apr_rate,intro_apr_duration, then reg_apr,reg_apr_type.

|

To identify the best credit cards of 2024, our experts compare the rewards, interest rates, and fees. We assure the tailored services of the Uthrive App outshine the rest.