The impact of inflation is making everyday purchases for essentials sting.

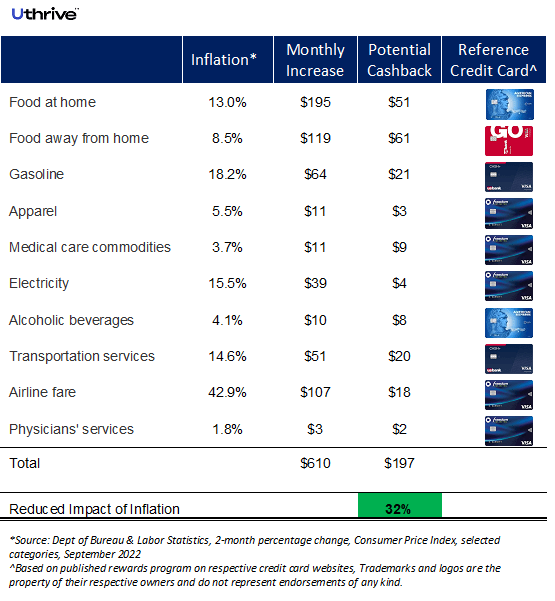

For a typical U.S. family with an average budget of $5,000 per month for essentials such as groceries and gas, that family would now spend an average of $5,610 for the same purchases due inflation according to Uthrive’s research and based on data from US Department of Bureau of Labor Statistics.

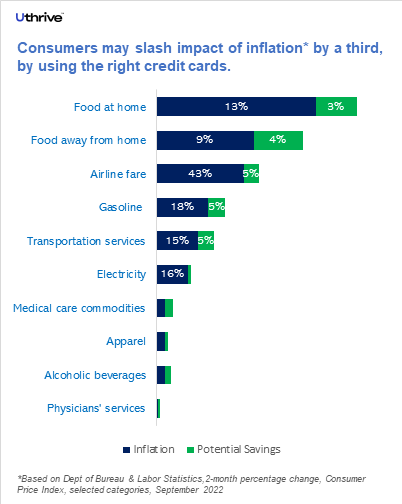

In other spending categories, the inflation sting feels more like a slap.

According to a recent analysis from Uthrive, spending amounts have increased the most from inflation in the following categories:

- Airline fares, 42.9% increase

- Gasoline, 18.2% increase

- Electricity, 15.5% increase

However, credit card rewards (particularly in the form of cash back) can be one of the tools for fighting the impact of inflation for people with stretched monthly budgets, tapering the impact of inflation by a third.

To determine the impact of inflation on a family’s monthly spending, Uthrive analyzed an “average” household budget of $5,000 to pay for essentials such as food, gasoline and transportation, eating out, electricity and travel. The analysis assumed the use of no annual fee cash back cards, such as card_name, card_name, U.S. Bank Altitude® Go Visa Signature® Card or U.S. Bank Cash+® Visa Signature® Card.

By using the credit cards with the highest rewards value at checkout, consumers could get cashback up to $200 each month to help alleviate the impact of inflation on their wallet.