Love shopping, but not a fan of spending all your salary? Credit cards are here for your rescue! Credit Card Shopping is the best solution to earn shopping rewards and get maximum credit card rewards on your spending.

Do you wish to get the best deal on the price? But fail to do so online or at a store? This blog will help you decide the best credit card for online shopping. Here are a few strategies to accelerate your shopping rewards.

Everyday Spending Rewards

One can easily collect reward points by getting a cashback credit card or a card that offers credit card reward points for each purchase. Signing up for such a card helps you extend the rewards that let you save on your purchases or buy more. Realistically, it is impossible to earn 5-6% or more for each purchase.

But there are ways to consistently enjoy rewards from your everyday spending using the card_name offers up to 5% cashback on all your purchases, available with no annual fee, it can be a big-time winner over time.

Category based Spending Rewards

If you keep track of where you spend the most of your monthly budget, then a category-specific card is the ideal choice for you. If you do not already have one, signing up for a customized category spending card allows you to earn a top-tier bonus as cashback or reward points. When you spend on these categories, you stand to rack up rewards pretty quickly.

Many credit cards fetch you a good 5% cash back in one spending category, such as grocery shopping or dining. If your maximum income goes in commuting, card_name from American Express would be an excellent gas card that gives 3% back on U.S. gas station purchases and the transits (Taxi, Tolls, Parking, Trains, etc.).

It also offers an additional 6% cash back at U.S. supermarkets (on up to $6,000 spending in a year and 1% afterward), 6% Cash Back on select U.S. streaming subscriptions, and 1% Cash Back on all other eligible purchases.

Store Specific Rewards

Are you one of those hardcore brand-loyal shoppers? If yes, you must apply for a store-specific cashback or rewards credit card. You will enjoy unlimited perks that would be very beneficial over every purchase you make. Such cards only come with one drawback- limited to just one brand or store chain.

Country’s top retailers like Amazon, Target, and Walmart reward up to 5% cashback on transactions made with their store cards while offering an extra discount to the cardholders. Another example of these cards includes Target RedCard™ Credit Card and Capital One Walmart Rewards Card.

For those who love to shop in bulk, stores such as Sam’s Club Mastercard, Costco Anywhere Visa® Card by Citi by Citi offer exceptional rewards for these store-specific purchases.

Big or Infrequent Purchases

Use your cash rewards credit card wisely and earn great reward points or cash back on your large purchases. These rewards become quite significant when you spend hundreds or even thousands of dollars on your purchases. Make sure to do a bit of research on determining the perfect credit card to earn the highest rewards before you go and spend on new furniture, latest gadget, or book a vacation.

card_name provides 5% cashback on bonus categories, do consider the time of your big purchase for higher rewards. It gives the cardholder a substantial 5% back on rotating categories for up to $1,500 every quarter (after activation) with 1% on all other purchases.

These cashback cards find you the best deals on big purchases. Similarly, the Chase Freedom Flex® provides a hefty 5% cashback for specific areas that change every 3 months. Furthermore, you can enjoy a 3% cashback reward on dining at restaurants and even for drugstore purchases.

Online Shopping Portals

Usually, people tend to overlook the impact of shopping portals as a medium to save money. Various sites help you earn cashback or points, which increases more during the holiday season.

Many credit card companies offer their shopping portals, where the cardholders can make purchases and boost the rewards they stand to earn. It allows you to stack on more points, miles, or cash back you would probably not receive otherwise.

You can shop through the Citi Bonus Cash Bonus Center (950+ Retailers) that multiply your card’s rewards- card_name, card_name, and Citi Custom Cash® Card. The Well Fargo Earn More Mall provides the best rewards on in-store purchases and online shopping further to the specific card points- Wells Fargo Active Cash® Card and Wells Fargo Visa Signature Credit Card.

Earning Rewards through Loyalty Programs

Apart from online shopping portals, loyalty programs are also a wise choice for earning the best credit card rewards. These loyalty programs assist you in points/miles, cashbacks, gift cards, and other rewards. Credit cards have been popularly delivering statement credit with a certain cashback percentage ranging from roughly 1% to 6%.

Some customers collectively use their points from their best online shopping card on cashback portals to boost their savings.

Fortunately, the loyalty programs have evolved over the years from buy 2 get 1 free to membership cards and smartphone apps. A few stores have recently upgraded to a four-level reward system ascertained through the amount spent by the customer.

Every customer receives a minimum of 1% reward, whereas someone who spends the highest gets a 5% reward, and they also procure various gift cards and special passes. The card_name provides Ultimate Rewards points under its Loyalty Program, redeemable for Apple Purchase, Amazon Orders, and over 175 gift card brands.

The Bottom Line

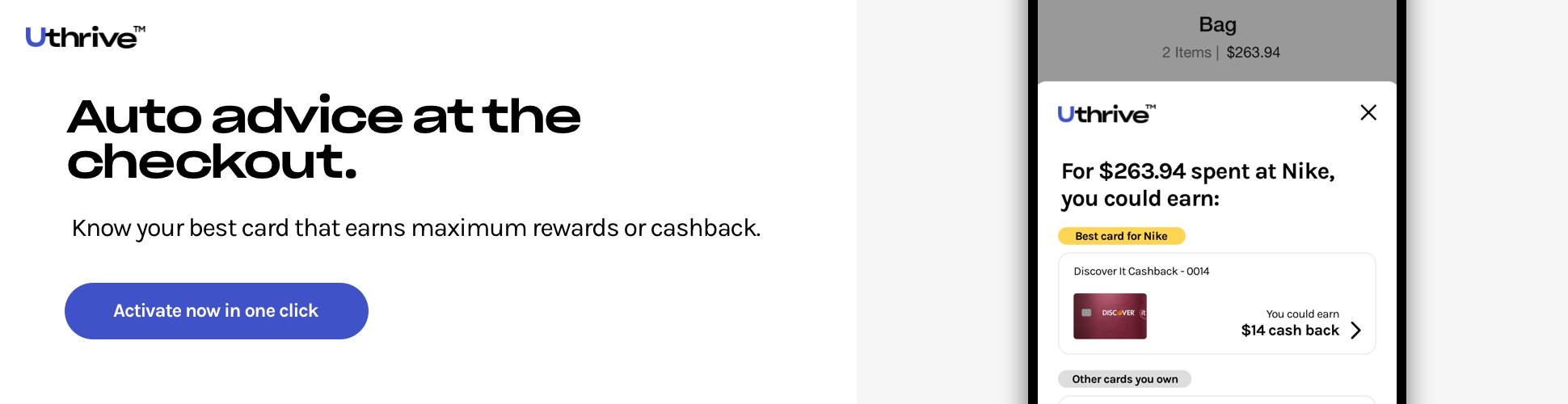

With people choosing e-commerce sites more than ever, credit card online shopping portals are immensely growing with the introduction of Mobile Apps. To use the best credit card while making a regular or big-time purchase, download the Uthrive App to determine your ideal card to maximize rewards or cashback for your next purchase. You will get personalized advice that helps you optimize your savings through credit cards.